Tag

pre-existing conditions

-

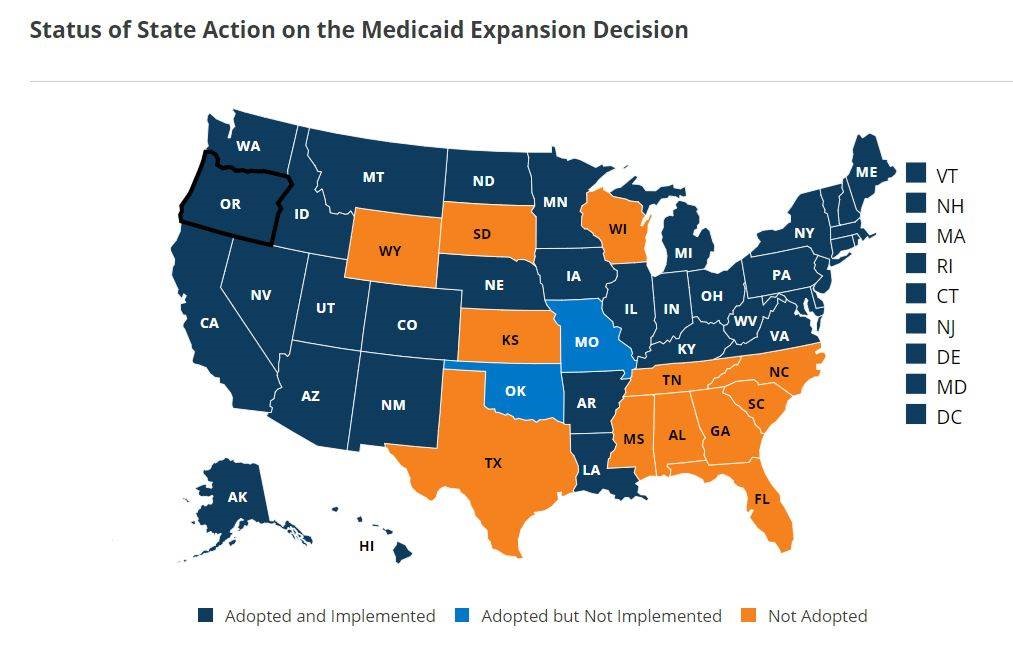

Supreme Court case on Affordable Care Act could have far-reaching effects on Medicaid expansion, pre-existing condition protections

On Tuesday, the U.S. Supreme Court will hear oral arguments on whether it should strike down the individual mandate and…

-

Actuaries report on shortcomings of short-term, limited-duration health plans

New research about short-term, limited-duration health plans shows that none of the plans studied covered pre-existing conditions and all had…

-

As name implies, short-term health plans may not be a good deal for some consumers

For an article on short-term health plans, journalist Nancy Metcalf found an ideal source: Stewart Lamotte, a 64-year-old retired restaurateur…

-

ACA lawsuit may cause chaos in the states

We earlier told you about one lawsuit that aims to take down the ACA – or at least wipe out…

-

Pre-existing conditions re-emerge: Find out who might be affected

The latest anti-Affordable Care Act lawsuit from a score of conservative state attorneys general – partly backed by the U.S.…

-

What to know about the DOJ’s latest whack at the ACA

The Obamacare wars have re-ignited, thanks to Attorney General Jeff Sessions, the U.S. Department of Justice, and a surprising assault…

-

Potential pros, cons of those short-term health plans

As promised, the Trump administration has released a proposed rule to allow short-term health insurance plans that do not conform…

-

Health care repeal bill would have dealt death blow to ‘essential health benefits’

A variety of fixes aimed at appeasing resistant conservative House members failed to save the GOP’s Affordable Care Act repeal…

-

Is reform adequately serving people in your area with pre-existing conditions?

This post is about high risk pools, so let’s get some confusing semantics out of the way. The Affordable Care…