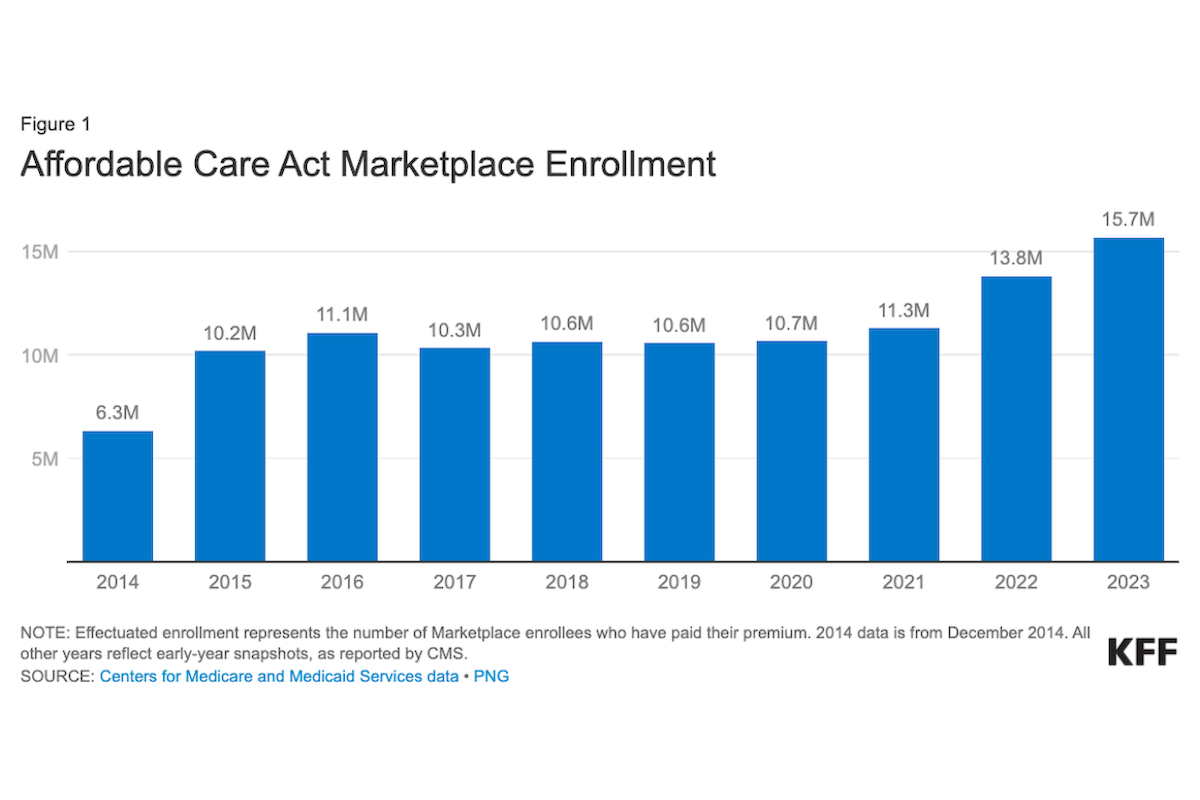

Low-cost health insurance coverage has led to record enrollment in the Affordable Care Act (ACA) plans, reaching 15.7 million consumers this year. Now that open enrollment is underway, however, many consumers may still be unaware that health insurance is more affordable than ever when shopping on the federal and state marketplaces at healthcare.gov.

When using the marketplaces, 80% of consumers will find insurance premiums costing $10 a month or less after subsidies (called an advance premium tax credit or APTC), according to a fact sheet from the federal Centers for Medicare and Medicaid Services. The other 20% of enrollees should not pay more than 8.5% of their modified adjusted gross income, CMS says.

Since 2021 and continuing at least through 2025, those enrolling in the Affordable Care Act plans (also called Obamacare) have seen low premium rates due to improvements the Biden administration and Congress included in the American Rescue Plan Act of 2021 and the Inflation Reduction Act of 2022, as KFF reported in September.

The record 15.7 million enrollees is 11.8% higher than the 13.8 million enrolled in 2022 and 32% higher than the 10.7 million enrolled in 2020 before Congress enhanced the funding for premiums. In an October report, KFF predicted that 2024 would see another enrollment record.

Debunk this myth

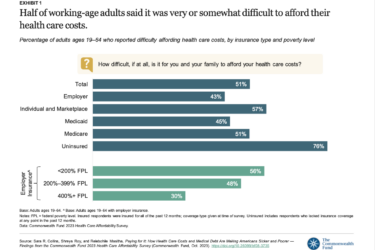

Low premium rates and record enrollment mean journalists can and should expose the myth that Affordable Care Act plans are too costly. Scammers running junk health plans profit from this falsehood by promoting insurance that lacks the marketplace’s consumer protections. Failing to cover the minimum benefits required in ACA-compliant plans, junk insurance can leave consumers with large unpaid health care bills. This blog covered junk insurance plans in August, January 2022, June 2021, and July 2020.

As healthcare.gov explained, open enrollment began Nov. 1. For those who enroll by Dec. 15, coverage starts Jan. 1, and for those who enroll by Jan. 16, coverage starts Feb. 1.

A word of caution

One of the pitfalls of covering the Affordable Care Act is the complexity of the premium subsidies that affect how much consumers pay after enrolling. Understanding the subsidies is important because most consumers will not pay full price for their coverage. Publishing only the higher rates before enrolling is misleading.

The subsidies are one of the Affordable Care Act’s best features and one of the most complex because they’re based on each consumer’s annual income. Under the American Rescue Plan Act and the Inflation Reduction Act, the Biden administration and Congress made the subsidies larger, more widely available and extended them through 2025, said Louise Norris, a health insurance broker in Colorado who writes for healthinsurance.org and wrote the site’s ACA Open Enrollment 2024 Guide.

The Affordable Care Act also provides income-based assistance that helps almost half of all policyholders get funding to pay for deductibles, copayments and coinsurance, which CMS calls cost-sharing reductions.

Use reliable sources

To see how the tax credits and cost-sharing reductions work, the aforementioned KFF report explains what enrollees can expect. Using a procedure called file and reconcile, all enrollees applying for tax credits must estimate their income so that the marketplaces can set their premium rates. Enrollees who got premium tax credits in the previous year must reconcile the subsidies when filing their federal tax returns with the IRS. During the pandemic, the file and reconcile requirement was waived but is in force now, KFF explained.

For example, Norris explained, if an Affordable Care Act enrollee had paid full price (without a subsidy), the average total monthly premium would have been $605. After enrolling and estimating the enrollee’s annual income, however, the tax credits reduced the average monthly premium to $124, she added.

The reduction of $481 per month equals $5,773 in a year and came as a result of the Affordable Care Act and the subsidy improvements in the American Rescue Plan Act and the Inflation Reduction Act, she explained.

“Most often, I see journalists reporting the average full price without subsidies but then they add that the average enrollee actually pays the lower amount,” Norris said.

For journalists seeking more details, Norris cited a March CMS report. Of the record 15.7 million consumers enrolled in Affordable Care Act plans this year, 14.3 million (91%) of them got subsidies, according to the CMS report. Also, 48% of the 15.7 million qualified for funding to defray their deductibles and other cost-sharing requirements.

To verify what a typical consumer would pay, reporters and consumers can use the estimator on healthcare.gov called the See Plans and Prices Tool, Norris suggested. “Any journalist or a consumer would find it simple to use the plan comparison tool to estimate what they’d pay with and without a subsidy, and it’s all anonymous,” she said.

When covering this story, two recent reports from the National Center for Health Statistics at the Centers for Disease Control and Prevention may be useful because they show the geographic variation and the demographic variation in health insurance coverage for 2022.

Resources

- This report from the federal Department of Health and Human Services, State Fact Sheets: Impacts of the IRA and ACA on Lowering Health Care Costs, has details on enrollment and average insurance costs in each state.

- KFF’s Health Insurance Marketplace Calculator allows consumers to estimate 2024 health insurance premiums and subsidies. It’s available in English and in Spanish.

- KFF’s frequently asked questions, FAQs: Health Insurance Marketplace and the ACA, are available in English and Spanish.

- Geographic Variation in Health Insurance Coverage: United States, 2022, Terlizzi, Emily P.; Cohen, Robin A.; National Center for Health Statistics, published Nov. 9, 2023.

- Demographic Variation in Health Insurance Coverage: United States, 2022, Cohen, Robin A.;Terlizzi, Emily P.; National Center for Health Statistics, published Nov. 9, 2023.