Health insurance provides insufficient coverage for the care most Americans need, a recent survey shows.

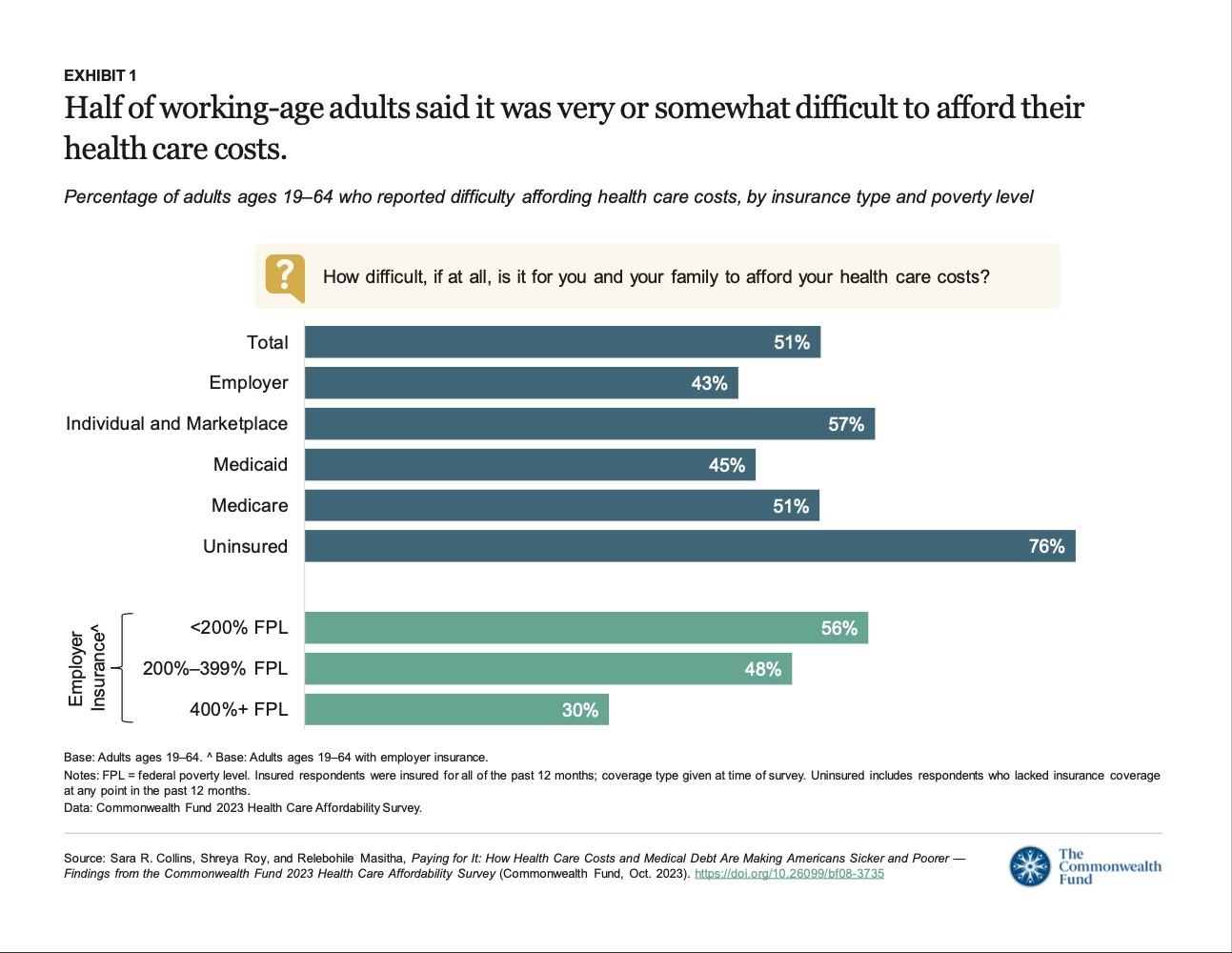

Half of all working-age adults with health insurance struggle to pay for health care and one-third carry medical debt, according to the report, “Paying for It: How Health Care Costs and Medical Debt Are Making Americans Sicker and Poorer,” from the Commonwealth Fund.

While most Americans are aware of the failings of the U.S. health insurance system, the report shows that inadequate health insurance coverage leads to worsening health and rising medical debt. It also causes consumers to delay or skip care altogether, the researchers explained.

Published Oct. 26, the report challenges the widely held assumption that health insurance in the United States buys affordable access to care.

For health care journalists, the report raises a timely and significant question: What health insurance is best when seeking to avoid high health care costs and medical debt? For at least another week, enrollment is open for Affordable Care Act (ACA) plans (also called Obamacare). Coverage begins Jan. 1 for consumers who sign up by Dec. 15, and coverage begins Feb. 1 for those who enroll by Jan. 16, as this blog reported Nov. 22, “For 2024, 80% of ACA enrollees can get health insurance for $10 a month, CMS says.”

Healthy and insured at risk

Having health insurance is always better than not having it, as the researchers noted, but even healthy and insured Americans can fall into medical debt and skip getting care, said Sara R. Collins, lead author of the research and vice president for health care coverage at the Commonwealth Fund.

Americans who didn’t get care because of cost couldn’t afford to pay for care even though they were insured and mostly healthy, she said. “We asked that group of people who delayed care whether a health problem got worse because they didn’t get that care,” she explained. A significant majority of respondents said, yes, regardless of whether their insurance was from an employer, Medicare, Medicaid, the individual market or www.healthcare.gov, she said.

Many people avoid getting care they need because out-of-pocket costs are too high, Collins added. “That points to the need for fixing or improving health insurance across all sources of coverage,” she said.

Avoiding out-of-pocket costs

In an interview, Xavier Becerra, secretary of the federal Department of Health and Human Services, explained that HHS has made it easier for consumers to find health plans that provide adequate coverage and that meet their needs to avoid high out-of-pocket costs for deductibles, coinsurance and cost sharing.

“One thing that we’ve heard from consumers a lot is there are so many choices,” he said. “How do I know which one looks best for me? And so rather than have people focus on the shiny object, we’re giving them a solid plan to enable them to choose among those plans.”

In the past, consumers got frustrated when unable to recognize which plan was best for them and their family, he added. “We’ve made that easier because we’ve tried to make sure that there are certain floors to some of these plans,” he said. “In this way, we take the guessing game out of it.”

Making it easier to compare plans

Collins went into more detail, explaining that HHS added limits this year to make it easier for consumers to compare plans. “And, related to that, consumers have a tool that will sum up their total costs for what they can expect to pay over the course of a year given their plan design, including their premium and potential out-of-pocket costs,” she said. This improvement is significant for consumers because in the past, those shopping on the ACA marketplaces (at www.healthcare.gov) would focus on what Becerra called the shiny object (the monthly premium) but then could fail to recognize that low-premium plans often have high out-of-pocket costs.

“Actually, the plans are sorted now on that total cost measure from low to high, rather than just by premium,” Collins explained. “The premium is only part of the story because you can choose a low premium plan and then end up with a really high deductible that might leave you exposed to high health care costs and maybe significant medical debt.” Such improvements should protect consumers from unexpected health care costs, she added.

Another improvement HHS made at www.healthcare.gov allows consumers to choose plans based on whether they expect to need health care services at a low, medium, and high level in the coming year, Collins noted. “The plans are sorted by low to high total yearly cost estimates, which includes your premium plus your potential out-of-pocket costs based on the design of the plan you’re considering,” she said. “This feature should help people make more informed decisions about their ability to reduce the potential for accumulating medical debt.”

Analyzing survey results

The survey results also call into question the idea that the ACA should be eliminated and replaced with something better, as two presidential candidates proposed since the report was published. Neither candidate explained what would replace the ACA.

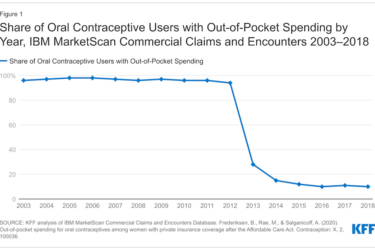

Since the law went into effect in 2014, enrollment has never been higher. One reason for high enrollment is the improvements the Biden administration and the Democrats made to ACA and its subsidies for consumers under the American Rescue Plan Act of 2021 and Inflation Reduction Act of 2022, as KFF reported in September. Since then, enrollment has hit records in each of the past three years and could hit another record in 2024, as we reported in our story on Nov. 22.

Other findings from the survey include the following:

- Large shares of insured working-age adults said it was very or somewhat difficult to afford their health care: including 57% with marketplace or individual-market plans, 51% with Medicare, 45% with Medicaid and 43% with employer coverage.

- Many insured adults said they or a family member had delayed or skipped needed health care or prescription drugs because they couldn’t afford it, including 42% with Medicare, 39% with Medicaid, 37% with marketplace or individual-market plans and 29% with employer coverage.

- Cost-driven delays in getting care or in missed care made people sicker, including 63% with Medicare, 61% in marketplace or individual-market plans, 60% with Medicaid and 54% with employer coverage.

- Insurance coverage didn’t prevent people from incurring medical debt, including 33% with Medicare and with marketplace or individual-market plans, 30% with employer coverage and 21% with Medicaid.

- Medical debt leads many people to delay or avoid getting care or filling prescriptions including 39% in marketplace or individual-market plans, 34% in employer plans, 32% in Medicare and 31% with Medicaid.

Resources

- Effectuated Enrollment: Early 2023 Snapshot and Full Year 2022 Average. This report shows enrollment in each state, how many have tax credits and how to get help to reduce what they pay for cost-sharing.

- State Fact Sheets: Impacts of the IRA and ACA on Lowering Health Care Costs, has details on enrollment and average insurance costs in each state.

- Geographic Variation in Health Insurance Coverage: United States, 2022, Terlizzi, Emily P.; Cohen, Robin A.; National Center for Health Statistics, published Nov. 9, 2023.

- Demographic Variation in Health Insurance Coverage: United States, 2022, Cohen, Robin A.;Terlizzi, Emily P.; National Center for Health Statistics, published Nov. 9, 2023.