To help health care journalists understand and navigate the complexities of the U.S. health insurance system, AHCJ has built a new tool, Insurance Media Guides.

A project of Georgetown University’s Center on Health Insurance Reforms and supported by the Robert Wood Johnson Foundation, the tool offers state-level primers on the number of residents who have insurance in each state, plus the District of Columbia and their source of insurance.

The overview at the top of the first section explains the patchwork system of health insurance coverage in the U.S., in which people’s access to services and level of financial protection — not to mention whether they have coverage at all — can vary depending on their birthplace, age, job, income, location and health status.

“Health insurance in the United States is so complicated, with rules and resources varying dramatically state-to-state. This makes reporting on consumers’ experiences with health coverage and the companies involved a real challenge,” said Sabrina Corlette, the center’s founder and co-director and leader of the project.

“We wanted to create a resource that would help journalists engage and inform their readers about the public policies and market forces impacting our access to affordable, comprehensive health care,” Corlette said.

Forms of insurance

The Insurance Media Guides include a description of each of the various kinds of health coverage that Americans use. The types of insurance include the following:

- Employer-sponsored health insurance (ESI), which is for workers and their family members, and is the nation’s largest source of coverage, insuring 49% of Americans.

- Medicaid and the Children’s Health Insurance Program (CHIP), which covers 21% of Americans, including individuals, children, people who are pregnant, some elderly Americans and those with disabilities and others with limited incomes.

- Medicare, which covers 15% of Americans who are seniors aged 65 and older and those with certain disabilities.

- Individual coverage. About 6% of consumers get individual and family coverage through the Affordable Care Act marketplaces, or they buy insurance online.

- The military provides coverage to about 1% of Americans.

- The uninsured. According to recent federal reports, some 8% of Americans are uninsured, but they often get care from hospitals, physicians and other providers even though they cannot pay for such treatment.

More tool features

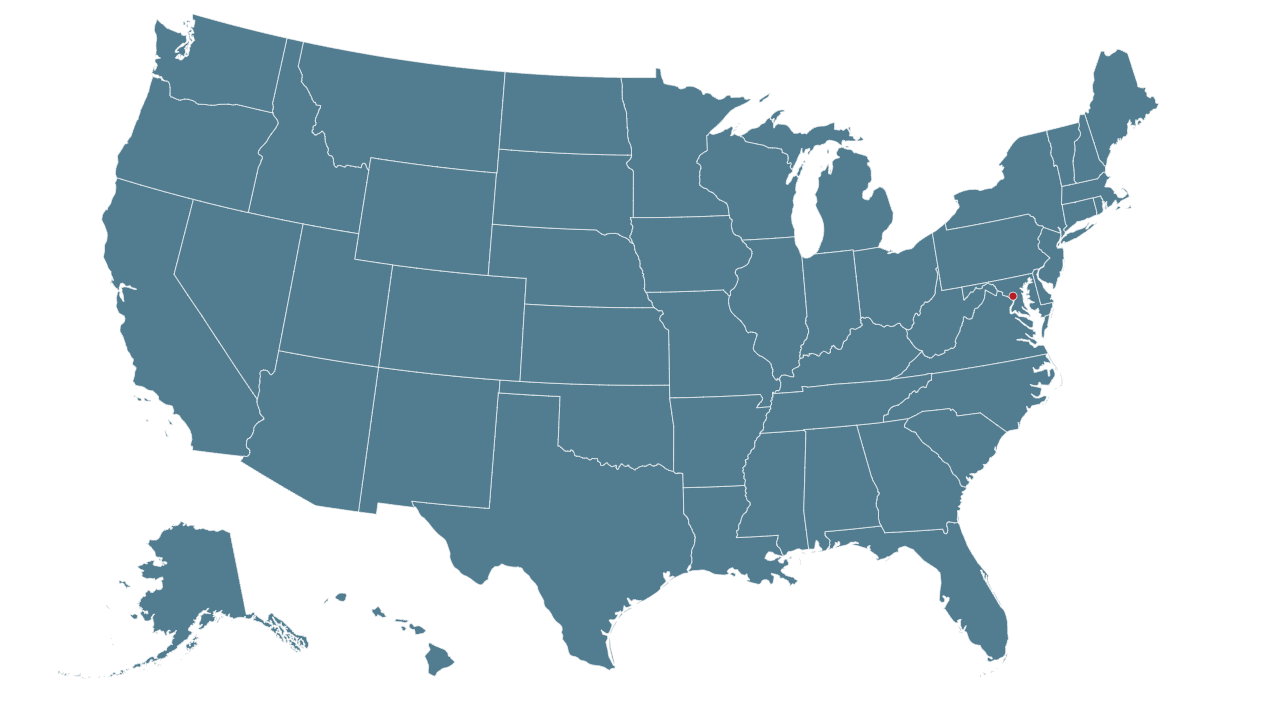

The Insurance Media Guides tool also features a description of the health insurance marketplace in each of the 50 states and the District of Columbia. The reports on each state include details on whether the state has expanded enrollment in Medicaid, as allowed under the Affordable Care Act, the various sources of insurance coverage and what type of marketplace the state runs for consumers seeking to enroll in the ACA.

For journalists covering the U.S. health insurance system, it’s also crucial to note two significant failings about the U.S. health insurance system. First, regardless of the source of coverage, health insurance is insufficient to cover all of the costs of health care that most Americans need each year.

Second, when researchers compare the U.S. health insurance system to that of other large high-income nations, the United States compares poorly in almost all significant categories. For example, health care in the United States is among the most expensive in the world in terms of administrative and other costs and yet patients’ outcomes are among the worst.