On July 1, the nation’s largest health insurer, UnitedHealthcare (UHC), stopped paying out-of-network claims when its fully insured members seek non-emergency care outside of their local coverage areas, according to Nona Tepper’s reporting in Modern Healthcare.

UHC’s decision to end some out-of-network coverage caught hospitals, physicians and other providers by surprise, she wrote, adding that the move could be aimed at controlling costs and reducing payment to providers.

If providers are surprised, so too could be many of UHC’s 49 million members, particularly those who need to get care outside of their coverage areas, such as those who live in rural counties and those who need treatment for substance abuse, Tepper wrote.

In her article, Tepper made two important points for journalists: First, she reported that UHC notified its hospitals, physicians and other providers of the new policy just days before the federal Department of Health and Human Services (HHS) issued an interim final rule on July 1 implementing consumer protections against surprise billing. Second, she quoted a lawyer who suggested other insurers may follow UHC’s lead.

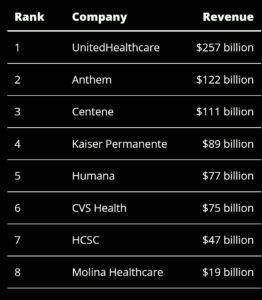

These facts suggest that insurers and groups representing hospitals and other providers are likely to find ways to circumvent or at least push back against surprise billing and new rules aimed at increasing competition. Keep in mind that many health insurers had record profits last year (as Reed Abelson reported for The New York Times) as did most — but not all — hospitals and health systems (as Jordan Rau and Christine Spolar reported for Kaiser Health News in April). Large surprise bills are among the ways they boost revenue.

UHC introduced the policy to some health plans for employers and individuals, saying those plans need to adopt the new restrictions in full by the middle of next year, added Tepper, who covers health insurance for the weekly magazine.

In an email to Tepper, a company spokesperson said UNC changed its policy to cut costs and improve care quality. “Anyone currently receiving treatment will be allowed to continue their treatment without disruption,” the spokesperson said.

Meanwhile, UHC’s parent company, UnitedHealth Group, reported a profit in the first quarter of $4.86 billion, a 40% increase over the same period a year ago, according to Christopher Snowbeck of the Star Tribune in Minneapolis.

Tepper said in her article that UHC notified its network hospitals, physicians and other providers of the new policy just days before the federal Department of Health and Human Services (HHS) issued an interim final rule implementing consumer protections against surprise billing. She quoted a lawyer who suggested other health insurers may follow UHC’s lead.

On Friday, President Biden issued an executive order directing HHS to support existing hospital price transparency rules and finish implementing bipartisan federal legislation to address surprise hospital billing. His order also outlined steps to increase competition in health care in four areas: prescription drugs, hearing aids, hospital consolidation and health insurance mergers.

Writing for The Wall Street Journal, Melanie Evans reported on Saturday that Biden’s order encouraged the U.S. Department of Justice and the Federal Trade Commission to review and consider revising guidelines for evaluating mergers. Evans’ article described how hospital consolidations had harmed consumers by raising hospital prices and failing to improve the quality of care. When hospital executives announce merger deals, they almost always proclaim without evidence that costs will decline and quality will improve, she noted.

Two of the largest hospital groups have criticized the Biden administration’s emphasis on slowing or stopping hospital consolidation. For example, Evans wrote, Chip Kahn, president and chief executive officer of the Federation of American Hospitals, said of the order, “Miring hospitals in legal and bureaucratic red tape will simply slow critical care to the bedside.”

Rick Pollack, CEO of the American Hospital Association, argued in the article that state and federal agencies already review proposed hospital mergers and that such deals can benefit hospitals that gain resources when joining larger systems.