Tag

IRS

-

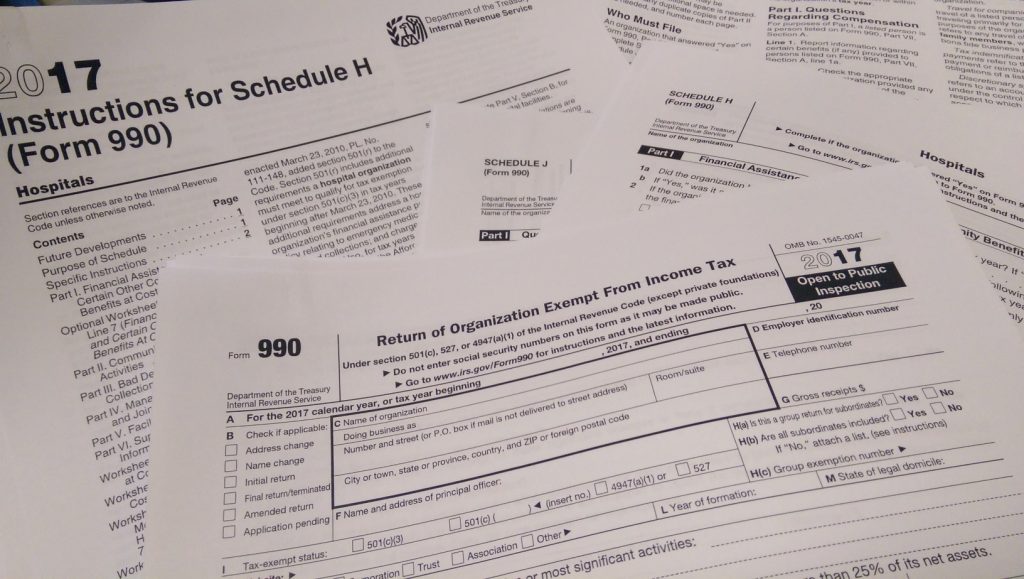

Start digging: AHCJ’s hospitalfinances.org website is back online

Hospitalfinances.org, a site AHCJ launched in 2018 to provide free, searchable financial information on nonprofit hospitals across the United States,…

-

Freelancers start national group to oppose independent contractor legislation

Spurred to action after the Protecting the Right to Organize (PRO) Act passed the House on Feb. 6, a group…

-

•

New site gives access to nonprofit hospital financial data

The Association of Health Care Journalists today unveiled hospitalfinances.org, a website that offers free, searchable financial information on nonprofit hospitals…

-

•

Proposed rule change aims at making family dental coverage more affordable

Oral health advocates are applauding a recently proposed federal rule they say would remove a significant financial barrier many parents…

-

Health Policy comes with new rules for nonprofit hospitals

When I first started covering health care, I thought that a nonprofit hospital was one that didn’t make any money.…

-

•

Credit crisis, IRS changes affect hospital finances (#ahcj09)

If ever there was a time to dig into your local hospital’s finances, this is it, Karl Stark told journalists…