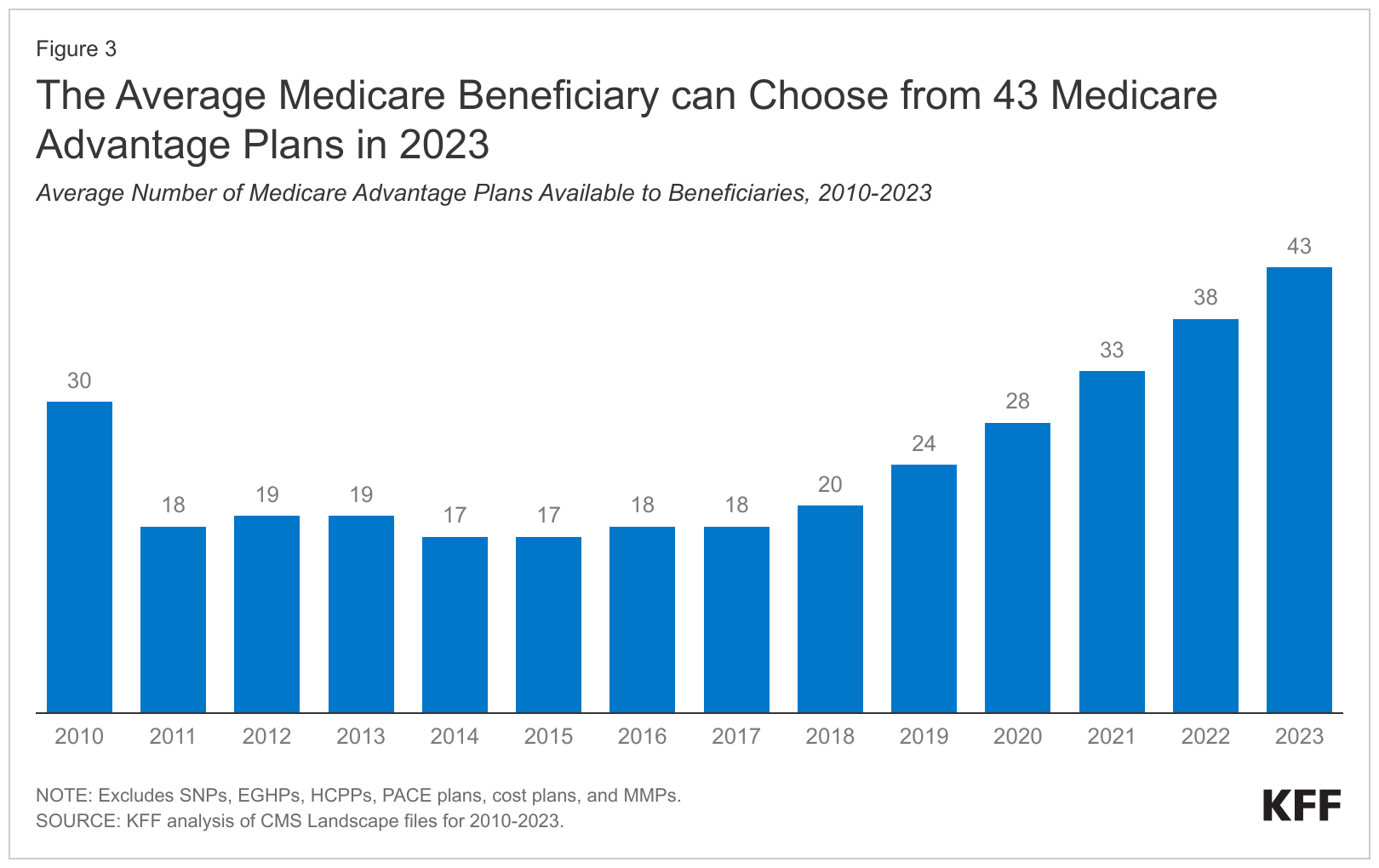

Since 2014, the number of Medicare Advantage plans available to the average Medicare beneficiary has more than doubled from 17 to 43 this year. Source: KFF report published Sept. 18, 2023, and accessed Oct. 16, 2023. Reprinted with permission.

Many Americans ages 65 and up have difficulty affording Medicare premiums and prescription drugs. Journalists have an opportunity to help their audience navigate our confusing health care system during Medicare’s open enrollment period.

Last year, staff and volunteers with the Medicare Rights Center saw a significant uptick in questions from older adults about Medicare affordability, how cost-sharing works and more, according to an Oct. 3 report from the Center. The number of questions about costs increased by 24% over the number reported in the previous two years (2020 and 2021), and, for the first time, cost concerns outnumbered inquiries about Medicare enrollment. More than a third of all calls to the center’s helpline (36%) were related to affording coverage, the center said.

The report is critically important now for three reasons:

- It’s timely because Medicare Open enrollment began Sunday Oct. 15 and runs through Dec. 7 for coverage that will start Jan. 1.

- It shows the significant role health care journalists have in explaining how older adults can get the financial and enrollment help they need and get their questions answered about Medicare Advantage.

- Many older adults about to enroll in Medicare or Medicare Advantage plans are unaware of the various forms of financial assistance available, said Darren Hotton, the associate director of community health and benefits for the National Council on Aging in Arlington, Va.

Many older adults may be reluctant to take control of their health care, according to Hotton.

“Open enrollment is their opportunity to decide which benefits they want so they can get better coverage and better savings,” he said. “Being actively engaged in their health coverage is necessary to age well because it will help with your financial stability, mental health, mobility and everything else.”

During open enrollment, older adults can: review the features of Medicare Advantage plans and switch from traditional Medicare to an Advantage plan (or vice versa); switch from one Advantage plan to another; and choose or switch to a different Medicare Part D prescription drug plan, according to a Sept. 18 KFF report.

The need to be well-informed

Understanding open enrollment is important now because some Medicare Advantage sales tactics can lead older people to enroll in plans that do not meet their health needs, my colleague Liz Seegert reported last month.

Senior producer Leslie Walker had a similar take in an excellent episode of the Tradeoffs podcast, “Medicare’s Open Enrollment Mess.” Walker explains that older adults who choose flawed plans can waste their often-limited income, may get lower-quality care and can find it difficult or expensive to make changes later.

Like Seegert, Walker cited a new report from the Commonwealth Fund that shows almost all older adults get marketing materials from Medicare Advantage insurers and one in three get seven or more telemarketing calls every week.

Gretchen Jacobson, vice president of the Commonwealth Fund’s Medicare program, said the number of unlawful sales tactics and activities that suggested fraud surprised the researchers.

In an Oct. 14 New York Times article, Mark Miller explained that federal regulators now require all television ads to be approved in advance and to add new standards for all marketing, including direct mail, email and phone calls.

Another problem is that open enrollment is extremely complicated, as Michelle Singletary explained in an Oct. 13 Washington Post article.

“The typical response is people look at it and they think, ‘Oh my goodness, I just don’t want to deal with it,’” Louise Norris told Singletary. Norris is a health policy analyst for HealthInsurance.org and MedicareResources.org. Indeed, the average Medicare member can choose among 43 Medicare Advantage plans and 24 Part D prescription drug plans, according to the KFF report.

Due diligence required

To smooth the way and avoid being misled, older adults should call or meet with a counselor from the State Health Insurance Assistance Program in their area, said Hotton, a former counselor for the program. Funded by the U.S. Department of Health and Human Services, the program provides free, unbiased, one-on-one counseling and enrollment assistance.

Before enrolling in any Medicare Advantage plan, Hotton recommended confirming that the plan includes your primary care and specialist physicians and your hospital is in its network. Out-of-network care will be more costly or not covered at all. To be certain, call each physician and hospital to confirm they are in your plan, he said.

The same is true when choosing a Part D prescription drug plan. A State Health Insurance Assistance Program counselor will help narrow your choices and will ensure that the prescriptions you take are included in the plan’s formulary. The counselor also will review your plan’s out-of-pocket costs, including copayments, deductibles and coinsurance.

This process is important because formularies and out-of-pocket costs can change every year, said Jenny Chumbley Hogue, a health policy analyst for MedicareResources.org.

Financial assistance is available

If newly enrolled in Medicare, some older adults may hesitate to say they have trouble paying for Medicare or may not know that some Medicare programs can make coverage more affordable, Hotton said.

State Health Insurance Assistance Program counselors can help with this process too. Older adults can apply for assistance to pay the $174.70 Medicare Part B premium in 2024 or to enroll in the Medicare Savings Program or in Medicaid if they qualify, Hotton said.

There are four Medicare Savings Programs that help low-income older adults pay for their Medicare premiums and out-of-pocket costs, such as deductibles and coinsurance, as the National Council on Aging explains here.

Those who cannot afford their prescription drugs should ask about the Extra Help Program which could limit how much they need to pay for each drug the Part D plan covers, NCOA said. In 2023, those in the Extra Help Program would pay no more than $11.20 for each drug covered, the council added.

The Extra Help Program

The Inflation Reduction Act of 2022 includes several provisions to reduce the cost of prescription drugs, as the nonprofit Medicare advocacy group California Health Advocates explains. One of those provisions expanded eligibility for Medicare’s Extra Help Program to individuals with incomes up to 150% of the federal poverty level, or $21,870 per year.

In June, the Department of Health and Human Services announced that the 300,000 low-income Medicare members currently enrolled in the Extra Help Program could be eligible to pay no deductible or premium and have lower copayments for certain drugs starting in 2024. On average, those members could save almost $300 per year, HHS estimated.

Additionally, up to 3 million older adults and people with disabilities not currently enrolled in Extra Help could be eligible to enroll now for 2024.

This year, Medicare members enrolled in Extra Help will have their prescription drug spending capped at $7,400 (meaning what the individual and the Part D plan paid together). After reaching that amount, the individual would pay nothing for each covered drug. In 2024, the spending cap will rise to $8,000, according to HHS.

Some older adults are reluctant to apply for financial help because they may mistakenly believe such assistance is like welfare, Hotton noted.

“But these people are entitled to their benefits because they’ve paid their taxes,” he said, adding that taxes for Medicare come out of every worker’s paycheck.

Resources

- 2024 Medicare Parts A & B Premiums and Deductibles, U.S. Centers for Medicare and Medicaid Services, Oct. 12, 2023.

- Medicare Open Enrollment Resource for Journalists and Annual Trends Report, Medicare Rights Center, Oct. 4, 2023.

- Medicare Open Enrollment 2024 Guide from MedicareResources.org.

- Medicare Advantage in 2023: Enrollment Update and Key Trends, KFF, Aug. 9, 2023.

- Medicare Advantage in 2023: Premiums, Out-of-Pocket Limits, Cost Sharing, Supplemental Benefits, Prior Authorization, and Star Ratings, KFF, Aug. 9, 2023.

- Key Facts About Medicare Part D Enrollment and Costs in 2023, KFF, July 26, 2023.