What lies ahead for Medicare now that election results are in?

Two words sum up the short-term outlook: cost cutting.

Judith Graham (@judith_graham), AHCJ’s topic leader on aging, is writing blog posts, editing tip sheets and articles and gathering resources to help our members cover the many issues around our aging society.

Judith Graham (@judith_graham), AHCJ’s topic leader on aging, is writing blog posts, editing tip sheets and articles and gathering resources to help our members cover the many issues around our aging society.

If you have questions or suggestions for future resources on the topic, please send them to judith@healthjournalism.org.

Down the road, a more ambitious and difficult task awaits: restructuring the program and realigning its incentives to create a lower-cost, higher quality, more sustainable health care system.

What isn’t on the horizon is a radical overhaul of Medicare along the lines that the Republicans proposed. Converting Medicare to a premium-support model isn’t going to happen, at least not any time in the foreseeable future.

Just after the election, AHCJ asked three distinguished experts – Karen Davis of the Commonwealth Fund, Joseph Antos of the American Enterprise Institute and John Rother of the National Coalition on Health Care – to weigh in on the outlook for health programs that serve seniors. Medicare held center stage during most of that web chat.

All three experts said that traditional Medicare isn’t sustainable and that a top priority should be reimbursement reforms that shift the program away from “paying for volume” to “paying for value.”

Although Medicare spending per capita has slowed, total spending will soar as tens of millions of baby boomers become eligible for the program, putting intense pressure on the federal budget, said Davis, president of the Commonwealth Fund.

With a 27 percent cut in Medicare reimbursement for physicians due to go into effect in January, the most immediate task for legislators is averting that, panelists agreed.

Next will come dealing with the “fiscal cliff” (a package of automatic tax hikes and spending cuts) that could throw the country into another recession, according to the panel. While an end-of-the-year deadline looms, that will surely be extended into next year, the panelists predicted.

“A key issue is whether Medicare and entitlement reform” will be part of these “fiscal cliff” discussions, Davis said. “Short term savings” in Medicare above and beyond those already proposed by the administration will likely be a focus, suggested Rother, president of the National Coalition on Health Care.

(President Obama had previously announced plans to cut projected increases in Medicare spending by $716 billion over a 10 year period. That’s now a floor for cuts that will be upcoming.)

One idea that’s sure to be put on the table is raising the age of eligibility for Medicare from 65 currently to 67 sometime over the next decade. Health Policy makes that possible by creating insurance exchanges through which older adults can get subsidized coverage, Davis noted. But Rother said raising the age of eligibility was a “bad idea” because it wouldn’t save much money but would instead shift costs to consumers and businesses.

Also sure to be debated over the long run is the question of how overall Medicare spending will be controlled. Will it be through the Independent Payment Advisory Board, a controversial organization created under the Affordable Care Act to keep Medicare spending in check? (See this Kaiser Health News article for a quick overview.) Or will it be through market-based mechanisms, an approach favored by Republicans?

What seems clear is that “Medicare will have to operate under budget constraints for the first time,” said Antos, the Wilson H. Taylor Scholar in Health Care and Retirement Policy at the American Enterprise Institute.

He spent time early in the AHCJ web chat outlining changes to Medicare’s structure that could make the program less confusing and more like private health insurance that most people are familiar with. His suggestions include combining Medicare Part A and Part B (in very simple terms, inpatient and outpatient services), creating a single deducible, simplifying cost sharing, and capping maximum out-of-pocket payments.

The goal is to make the program easier to navigate and, also, to make it easier for beneficiaries to understand the cost implications of choices they make, Antos said.

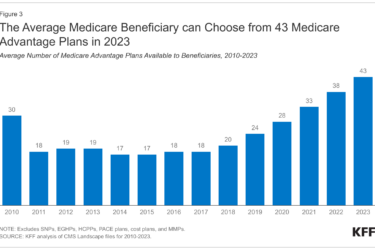

As for Medicare Advantage, Antos suggested that it become a more “competitive program” whose payments are no longer tied to traditional Medicare.

Rother outlined seven changes needed to make Medicare, as well as the health care system overall, more affordable. Proposed policies include payment reforms, consumer engagement, an expanded role for competition, better coordinated care, and more prevention; they’re outlined in a document the National Coalition on Health Care released after the AHCJ web chat.

Overall, “we’re going to have to do a better job of getting value for our health care dollar,” Rother said.

In that vein, Medicare’s emerging efforts to become more innovative are important. These include new models of delivering care such as accountable care organizations, new models of paying for care such as value-based purchasing and bundled payments for acute care episodes, and efforts to enhance care coordination, improve handoffs between healthcare settings, and reduce avoidable nursing home hospitalizations.

See AHCJ’s tip sheet, “Latest Innovations in Medicare,” for more information.

As for story ideas, other than keeping an eye on Medicare the panelists recommended that journalists reporting on aging stay abreast of developments vis a vis Medicaid in their states. Medicaid is the largest payer of long-term care services for older adults in the United States, and budgetary pressures on state Medicaid programs have important implications for seniors, they noted.

Also, watch for what’s happening to state programs that help seniors age in place in their communities while receiving assistance with in-home care, respite care, housing and heating costs, home-delivered meals, and other services, they recommended. Howard Gleckman made a similar point this week in a Forbes piece that draws attention to several smaller senior programs at risk as legislators prepare to deal with the “fiscal cliff.” I strongly recommend his piece, as well as listening to the AHCJ web chat if you haven’t had a chance to do so already.

Also, watch for what’s happening to state programs that help seniors age in place in their communities while receiving assistance with in-home care, respite care, housing and heating costs, home-delivered meals, and other services, they recommended. Howard Gleckman made a similar point this week in a Forbes piece that draws attention to several smaller senior programs at risk as legislators prepare to deal with the “fiscal cliff.” I strongly recommend his piece, as well as listening to the AHCJ web chat if you haven’t had a chance to do so already.

UPDATE: The Center for American Progress weighed in this week with another set of proposals for squeezing $385 billion from Medicare and Medicaid without compromising seniors’ care. This is the name of the game now: finding ways to control costs without sacrificing benefits, jeopardizing access, or negatively impacting quality of care.